Businesses thrive on strong finances. When finances are well-documented, it narrates the story of survival, its missteps, and its ambitions. However these complexities can be challenging for a layman’s understanding.

Let’s understand the different types of financial statements, how they work, why they are essential, and typical mistakes to avoid. Explore accounting principles and basics, so you can better understand these records.

TL;DR

Financial statements are the backbone of any business, which help track business performance. Analyse business performance by checking the organisation’s cash flow, income statements, balance sheets, and financial accounting, helping you make smarter decisions.

What Are Financial Statements?

Simply put, financial statements in accounting are official records that list a business’s assets, liabilities, income, and expenses for a specific period. They help investors, lenders, managers, and regulators make informed decisions and demonstrate that the company is financially healthy.

This concept is easier to understand if we use Netflix as an example. In Netflix, while the income statement and balance sheet make it easy to see how subscription fees generate revenue, the cash flow statement breaks out the costs of producing shows like Stranger Things. These documents altogether show how the business is doing and what its plans are for the future.

Key Types of Financial Statements

As a part of financial reporting, companies are expected to generate multiple reports. The four main types of critical financial reporting include

- Profit and loss statement (income statement): This gives a detailed look at the net profit, costs, and income. It tells you quickly and clearly if the business made money or not.

- Balance Sheet: This is a financial snapshot of your assets, debts, and fortune. This indicates what the business owns, pays, and how much the owners have.

- Cash Flow Statement: This report analyzes financing, activities, and investments to track money flow. Even if the statistics appear favorable, it is impossible to generate revenue without cash.

- Statement of Changes in Equity: This is the less thrilling counterpart, yet it is of paramount importance. The changes in dividends, held earnings, and issued shares indicate how ownership changes over time.

These are the main financial statement types every company must prepare.

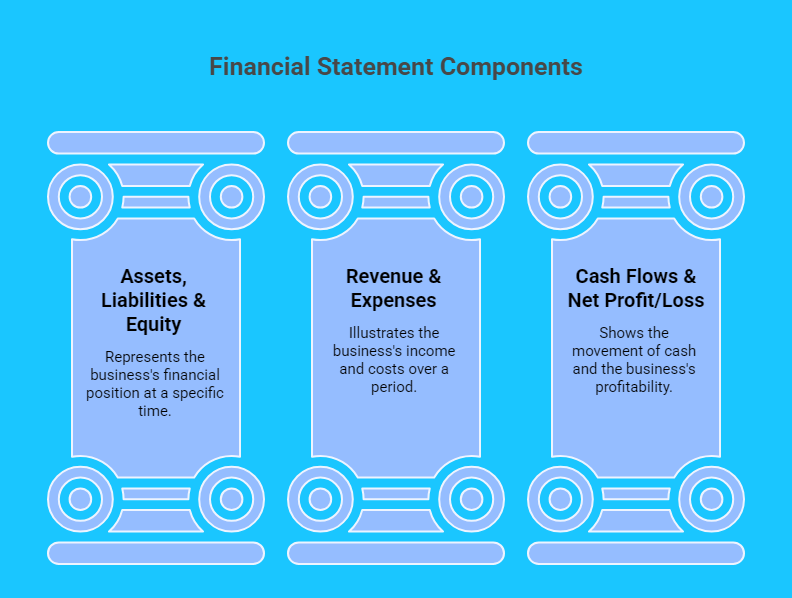

Components of Financial Statements

You must know the parts of a financial statement that the business legacy forward to. A typical financial statement included the following components:

- Assets, Liabilities, and Equity: The business owns assets, owes liabilities, and has equity after paying commitments.

- Revenue and expenses: They determine profitability by tracking money coming in and going out.

- Cash flows and net profit (or loss): Cash flows represent liquidity, whereas net profit shows performance and business sustainability.

Importance of Financial Statement Analysis

Turning numbers into insights is what financial statement analysis is all about. This analysis becomes important as it interprets numbers and determines if a company is profitable, cost-effective, or risky. It verifies if the available funds can cover ongoing expenses. It also oversees how effectively resources are being utilised in addition to checking debt. For instance, if a local cafe wants to determine if it has sufficient funds to cover its rent, employees, and any outstanding loans, it can review its financial statements. These insights can make or break an investment for investors, financiers, and managers.

How to Prepare Financial Statements

To prepare a financial statement, familiarity with accounting principles and jargon is important. Make sure everything is documented in a well structured recording tool like a book or software. Before making your trial balance, ensure all the figures are in perfect alignment. Reduce the value of old products and keep an eye on your bills. Fix any mistakes you find right away. Bring all parts together to complete the final account.

Financial statements, how to prepare, may seem overwhelming, but current accounting software handles most of it. Understanding the process improves your appreciation for the finished product and helps you discover inconsistencies.

Since Excel is one of the most widely used tools in accounting, learning how to automate tasks in Excel with Macros can save time and reduce errors during financial reporting.

Common Mistakes to Avoid

While putting together financial records, even established businesses can make crucial mistakes. If you want your financial statements analysis to be accurate and compliant, you need to avoid some common pitfalls. If cash flow is ignored, gains without liquidity will lead to major issues.

- By skipping depreciation, you may make more money today, but expect problems later.

- Mislabeling can cause problems, turning a small mistake into a major source of misinformation.

Conclusion

All matters related to finances are centrally stored in financial records. They make it easy for buyers, managers, and lenders to decide what to do. Knowing how to read these records can help you make smart predictions, plans, and investments. They satisfy regulatory requirements, promote firm growth, as well as reassure stakeholders about the system.

If you need support in analyzing financial statements, DG Training is here to help you. Explore our finance courses at DG Training Financial Accounting Courses to improve your skills and make informed smart business decisions.

Mastering financial statements isn’t just about business decisions — it’s also a core requirement for many top finance jobs in Dubai.

FAQs

Business health can be determined by bookkeeping. Reduced income, debt, or debt may indicate difficulty. Investors and managers must recognize early warning indicators to avoid failure or worsening.

Although boring, it indicates ownership, profit, and retained profits. Investors and others can determine a company’s long-term profitability and share value by tracking share movement.

Patents, branding, and software usually outperform cash. They affect financial decisions, amortization, depreciation, and balance sheets. The long-term prospects and strengths of a business depend on many things.

Yes. Financially impressive profits may not translate into cash. Late payments, excess inventory, and large receivables can make it hard to pay bills, invest, or develop, even if the income statement shows a good net profit.

Combining personal and corporate finances hides cash flow, profits, and obligations. It causes fraud, complicates checks, and increases the risk of prosecution. Investors, managers, and lenders may trust carefully segregated financial data and analysis.